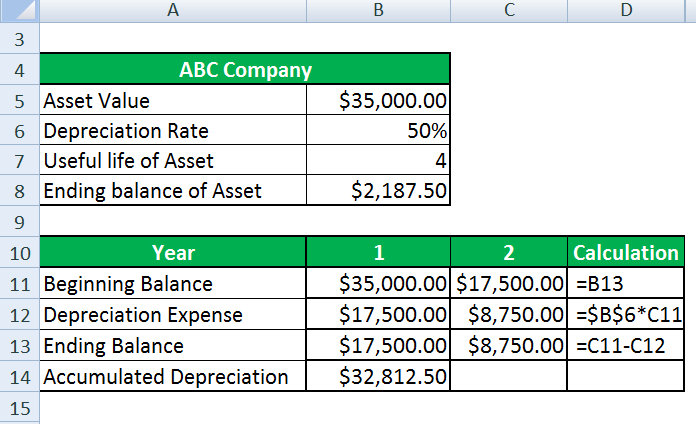

Diminishing value depreciation example

2 x basic depreciation rate x book value. In this example the base value for the second year of the asset will be.

Choosing Depreciation Methods Diminishing Value Vs Prime Cost

You use it 100 for business for the full year so do not need to work out business use percentage or months used.

. Diminishing Value Depreciation Method. Diminishing balance depreciation with residual value Entity purchased for 12 million an item of high-tech PPE subject to increased technical obsolescence. For subsequent years the base value will reduce based on the difference between the current year and the next year.

The entity assesses that the asset will be used for 5 years with most of. Expert assistance may be required. The tax depreciation rate will be 15 straight line or 2 diminishing value.

It has an effective life of five years. Your basic depreciation rate is the rate at which an asset depreciates using the straight line method. Tax depreciation of buildings was originally removed in May 2010 with effect for the 2012 income tax year.

For example care will need be taken when there have been additions to the building in later years. To get that first calculate. Using our example from step 2 your commercial espresso machines adjusted tax value is 7000 with a diminishing value rate of 30.

The benefits of double declining balance. Laura purchased a new hot water system for her rental property on 1 July 2021 for 1500. She can choose to use either the diminishing value or.

Dont worrythese formulas are a lot easier to understand with a step-by-step example. Calculating deductions for decline in value. If an asset costs 50000 and has an effective life of 10 years your first years deduction will be.

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Straight Line Vs Reducing Balance Depreciation Youtube

Written Down Value Method Importance Of Written Down Value Method

Depreciation Of Building Definition Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Written Down Value Method Of Depreciation Calculation

Accumulated Depreciation Overview How It Works Example

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Rate Adjustments Diminishing Value Depreciation Method Oracle Assets Help

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition